An Unbiased View of Shingles Vaccine Cost

Wiki Article

An Unbiased View of Medicare Select Plans

Table of ContentsAbout Medicare Part G8 Easy Facts About Apply For Medicare DescribedMedigap Cost Comparison Chart - Truths3 Easy Facts About Medicare Part G ExplainedHow Medigap Cost Comparison Chart can Save You Time, Stress, and Money.

Dual Protection Twin protection QMBs are qualified for both QMB benefits as well as cash money and/or medical benefits. HFS pays the coinsurance quantity, if any, while Medicare-covered SNF services are offered. The income of QMB qualified persons is never put on Medicare-covered SNF solutions. Ms. R is a Medicare Component A beneficiary that remains in a nursing home (NH).

Since countable income is less than the one-person QMB revenue requirement, Ms. S is likewise qualified for QMB benefits. Number offered earnings to put on long-term care (see as well as ). Get in the credit report quantity in the MMIS LTC subsystem. (Go into the credit history quantity in Section C of either Long Term Care Permission (Kind 2299) or Long-term Treatment Permission Update (Form 2449), as appropriate.) Sends out the facility a regular monthly prepayment kind based on the information in MMIS LTC system.

Does not collect the credit history amount revealed on the Type 2299 or Form 2449 for these individuals during a period of Medicare-covered SNF solutions. Ms. D is a Medicare Part A beneficiary that remains in an NH. She receives SSA of $670 month-to-month and also Medicaid. Considering that countable income is much less than the someone QMB revenue requirement, Ms.

Go into Ms. D's regular monthly readily available revenue in the MMIS LTC subsystem. This amount if figured to be $640 ($670 - $30 = $640). Get in the effective day of 07/01 as well as COS 65 in the MMIS LTC subsystem. (Go into revenue in Area C of Type 2449; get in 07/01 efficient day as well as COS 65 in Area D of Form 2449.) When the coinsurance duration starts, go into the reliable date of 07/21 and also COS 72 in the MMIS LTC subsystem (bankers fidelity medicare supplement reviews).

Apply resources that are more than the resource restricts to the client's regular monthly countable income when figuring the amount readily available to use to long-term treatment expenses. Figure the total up to relate to the August payment period. Go into 08/01 in the MMIS LTC subsystem with the quantity figured as a credit rating.

HFS pays Medicare costs, deductibles, and also coinsurance just for Medicare-covered services. Mr. J is a Medicare Component A recipient living in an NH.

Mr. J has actually been found eligible for QMB benefits. HFS will certainly spend for only Medicare premiums, deductibles, and also coinsurance charges for all Medicare-covered solutions. End Day Established Enter permission in the MMIS LTC subsystem to start a confess when: a QMB only client is getting Medicare-covered SNF solutions; as well as advantages are subject to coinsurance; and also completion day of the coinsurance is developed.

4 Easy Facts About Boomer Benefits Reviews Described

Get in the date the coinsurance period is effective in the MMIS LTC subsystem. Get in the date adhering to the date that the coinsurance period has actually been fulfilled in the MMIS LTC subsystem.

( Full Form 2449 when Medicare-covered SNF services end.) Usage Code D9, Discharge Location - Various Other, for this purchase. boomer benefits reviews. No payment is made for the discharge date for Code D9 discharges.

The Ultimate Guide To Medigap Cost Comparison Chart

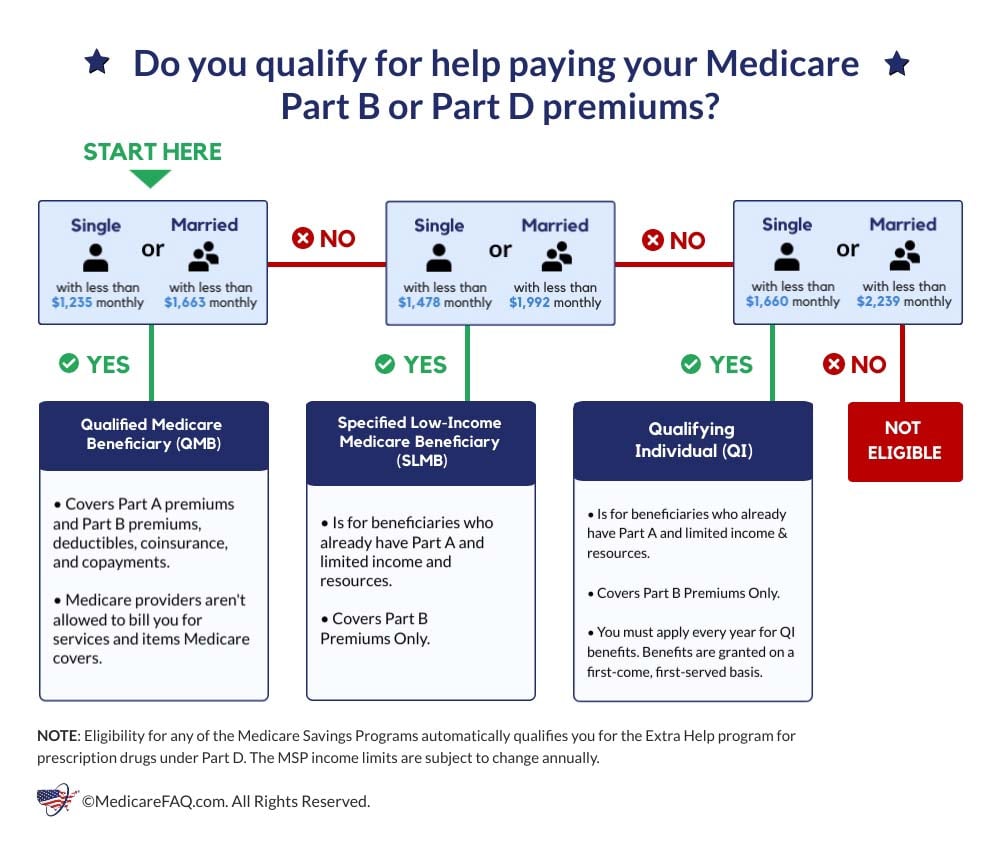

A program that assists Medicare recipients of modest methods pay all or a few of Medicare's price sharing amounts (ie. costs, deductibles as well as copayments).(Medicaid normally pays less than Medicare does for the very same services.) When Medicare's settlement is higher than the Medicaid price for a service, Medicaid may not pay anything for QMB cost sharing yet QMB enrollees still can not be billed greater than a little co-pay (if one is enabled under Medicaid).This can produce a predicament for wellness care providers who aren't accustomed to treating dual eligibles and also is a factor some enrollees choose not to share their condition as a QMB with every clinical supplier - how to apply for medicare part a. Medigap insurance firms can not purposefully offer a Medicare additional insurance plan to QMB enrollees (as well as this limitation also relates to those obtaining complete Medicaid advantages) - aarp plan g.

n QMB for future months. Example: Melba's earnings and possessions are within QMB restrictions. She go to my site requests SLMB advantages on a recurring basis so only her Part B premium will certainly be paid. She does not want QMB to cover Medicare co-payments and deductibles. Activity: Because she is qualified for QMB, Melba can not receive SLMB on a continuous basis.

The Facts About Medicare Part G Revealed

He lives with his better half, Joan, as well as their four youngsters. Activity: Utilize a household size of 6 for QMB. For MA/CADI utilize a home size of one. Constantly utilize a home dimension of one to identify QMB eligibility for an individual who is eligible for the Elderly Waiver (EW). Instance: Take legal action against obtains EW and is qualified for Medicare.Report this wiki page